The Main Principles Of Paypal Business Loan

Wiki Article

Paypal Business Loan - Truths

Table of ContentsThe Ultimate Guide To Paypal Business LoanRumored Buzz on Paypal Business LoanThe Only Guide for Paypal Business LoanThe 8-Minute Rule for Paypal Business LoanSome Known Details About Paypal Business Loan The 5-Second Trick For Paypal Business Loan

Numerous entrepreneur report sensation stressed when using for a tiny business finance. It seems that loan providers are requesting a growing number of documentation with each passing day. In truth, many loan providers have a basic discovery listing of records that are called for to make an application for and refine a finance. PayPal Business Loan. Recognizing which records will be called for and also obtaining that documentation in order before you request your service financing can decrease your tension and speed-up authorization of your lending.Be prepared to supply as much as 2 years of history. Not all loan providers will call for 2 years on all files, but many will certainly not call for even more than that. PayPal Business Loan. All the same, be prepared to provide all requested documentation.

Paypal Business Loan Things To Know Before You Buy

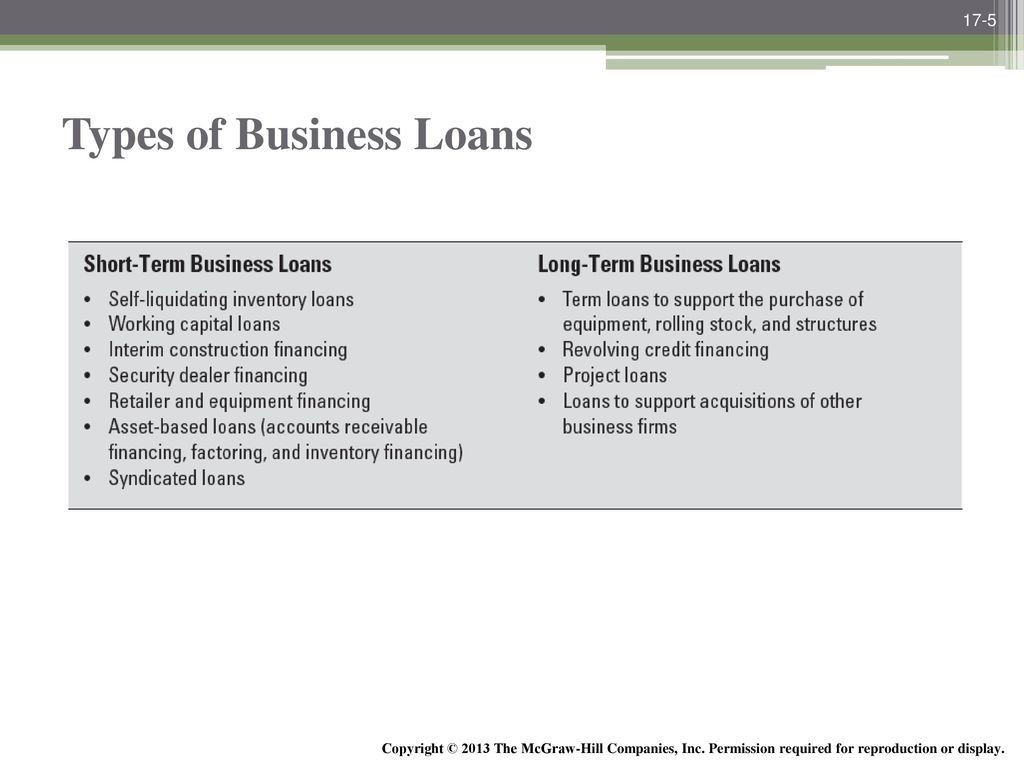

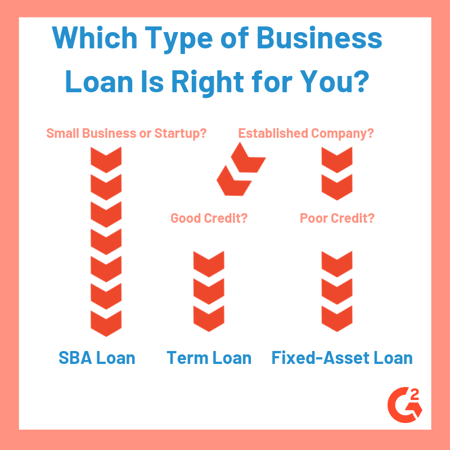

You can pick from a range of organization lending types and must research your alternatives to find the finest fit. Take into consideration the sorts of small-business fundings you can pick from: SBA financings. The SBA partly backs financings from offering companions, reducing their danger as well as improving access to capital for small companies.

Devices financing is a type of term funding that can be used to acquire and also expand the cost of machinery or tools for your organization. Generally, the tools is collateral for the finance. If your small company has a hard time with money flow because you're waiting on billings to be paid, you can utilize invoice financing, also referred to as factoring.

4 Simple Techniques For Paypal Business Loan

Particular energy-efficient or producing projects might certify for even more than one 504 car loan of up to $5. Businesses may use catastrophe car loans to fix or change machinery and also tools, inventory, and actual estate that was damaged or destroyed.Lots of small-business lendings can be utilized for a selection of business demands. Significant paperwork called for. Small-business funding applications can call for a large amount link of documentation, which may make the process prolonged. Restricted alternatives with negative debt. Small-business car loan applications are based partly on credit scores, and there are few lending choices for companies with poor debt.

Some online lenders are considered alternative lenders, which can provide more versatility than industrial financial institutions due to the fact that their funding products are less regulated. Alternative lenders supply lendings to customers that otherwise may not have access to small-business funding, such as start-ups or services with an unsteady economic background."Small services ought to be aware there are multiple channels available for borrowing required funds," claims S.

Online lenders may offer SBA use programs.

For instance, you could obtain a different finance for pay-roll than you would genuine estate. If a lending institution doesn't supply car loans in the amount you require, discover one that will. Clearing up for a reduced amount could worry you with a loan that drops brief of effectively addressing your capital demands.

The Basic Principles Of Paypal Business Loan

Temporary company fundings have higher month-to-month repayments than lasting fundings, however you will typically pay much less in total rate of interest due to the fact that you have the financing for much less time. The opposite is additionally real. A longer payment term could indicate reduced monthly repayments yet more in total rate of interest costs over the life of the funding.Look for a lender with the least expensive prices, consisting of: The interest rate is the rate of interest billed on your car loan yearly, plus all fees as well as prices related to the finance. Remember that advertised rates of interest might be where rates start; you can look here a rate check can approximate an APR for your small-business funding.

In many cases, the down repayment for your small-business finance is covered by security. Various other small-business car loans need an equity investment. Down payment requirements differ, yet expect to spend at the very least 10% to 30% of your very own funding when getting a lending. Factor rate. A factor rate is typically used for merchant cash loan as well as temporary service finances to establish just how much you will owe in interest.

The Best Guide To Paypal Business Loan

Personal car loans. Some personal loans are based on credit rating, and might not offer as much financing as small-business lendings. Household finances. If household members are able, you may inquire to funding you money for your service. Family financings can conserve you cash on interest, however they need to still include a clear payment strategy.Advertising and marketing factors to consider might influence where offers show up on the website yet do not influence any kind of content choices, such as which lending products we cover and how we evaluate them. This site does not consist of all lending business or all car loan provides offered in the marketplace.

Often, a bank loan is the response to assist you attain your organization objectives. Before you start filling up out applications, though, you'll wish to have a standard understanding of the bank loan landscape: what financing options are readily available, which ones are prominent, and how they work. In this overview, we'll cover those fundamentals and find more info some choices worth taking into consideration.

Report this wiki page